No More Greenwashing, ESG for VCs, ESG Ads and other ESG Trends to Expect in 2022

ESG has dominated corporate discourse in 2021 as companies scrambled to comply with reporting and disclosure principles demanded by investors and stakeholders. Luckily, Intaba Africa was there to hold our client’s hands and lead them to the brave new world of ESG.

We’ll resume normal service in 2022, a year when the term “sustainable investment” will become just investment as investors look to invest only with ESG-compliant firms.

There will be several other emerging trends, so we picked out the key ones for you to focus on:

Scrutiny Over ‘Greenwashing’ Will Ramp Up

Stakeholders and the media will demand companies walk the talk, not just engaging in “greenwashing”, that is when a company markets itself as sustainable whilst continuing to engage in activities that cause environmental harm.

Regulators will also begin to apply pressure by enforcing mandatory disclosures that force companies to move beyond marketing and PR to meaningful action.

Appointment of Chief Sustainability Officers and Expansion of Sustainability Teams

According to a report from CSO recruitment firm the Weinreb Group, there were more first-time CSOs recruited by Fortune 500 companies in 2021 than the previous three years combined. This is because businesses are aiming to assume more responsible practices with customers, regulators and investors demanding increased transparency of business ESG performance.

Sustainability teams are also getting bigger, with the average team size increasing from five professionals in 2011 to 15 these days, according to the report. One can only expect more manpower to be directed to this crucial department this year.

Development and Embedding of External and Internal ESG-Specific Data

Growing calls for mandatory ESG disclosures across entire operating models will necessitate the need for the development of ESG scoring tools that can be used for decision making and reporting.

2022 will also see a higher degree of international standardization and harmonization in ESG data and disclosures from corporates and financial institutions. This was one of the most often cited sources of frustration and inconsistencies for ESG integration strategies among asset owners and managers and investors last year.

ESG Considerations in Supply-Chain Management

Regulatory pressure to consider environmental and social risks as well as shifting consumer preferences for sustainable products have underscored the importance of sustainable, resilient, ethical and transparent supply chains. Additionally, the disruption caused by COVID-19 has stretched global supply chains to the limit and necessitated companies to focus on improving their supply chain resilience, including turning to external services for help.

These companies will therefore have a busy year analyzing their supply chain and procurement processes to identify areas of concern related to ESG risks, evaluate solutions to safeguard themselves from risk and consistently implement future-proof ESG principles throughout their distribution network/supply chain.

ESG Credentials Being Used In Adverts for Direct Consumers

ESG Investment Funds Will Push Capital Flows into Africa, Asia And Emerging Markets

According to CNBC, a total of $51.1 billion of net new money was invested into ESG funds in 2020, more than doubling the prior’s year’s figure. This is because investors believe that integrating ESG factors into company valuations enhances traditional analysis by identifying newfound risks and opportunities that go beyond fundamental metrics.

These funds were mostly concentrated in North America and Europe, but as Intaba Africa helps firms in Africa to comply with ESG, you can expect investors to train some focus on emerging markets too.

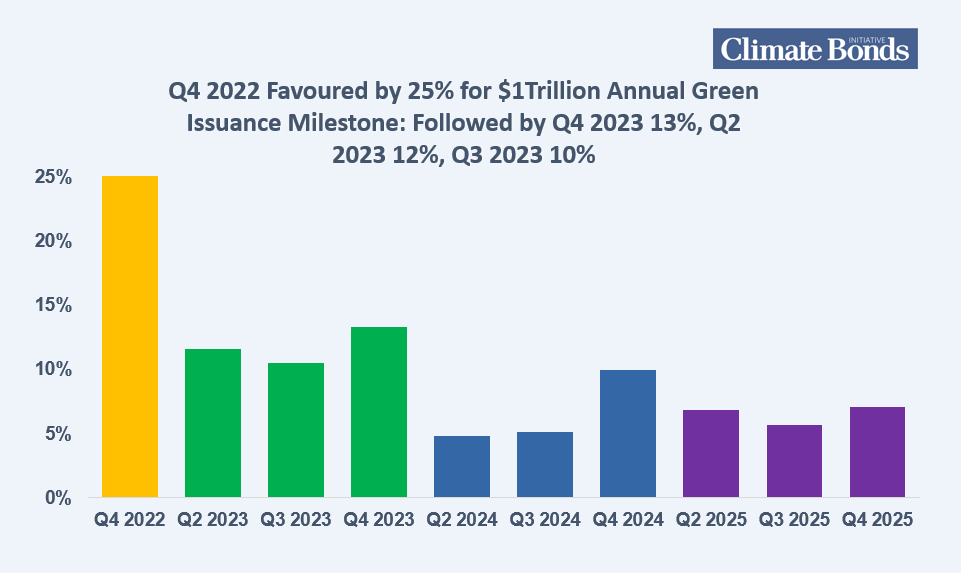

Rise and Rise of Global Green Bond Issuance

The popularity of the so-called green bonds to raise money for low-carbon projects is increasing as corporations and financial institutions feel the pressure from investors to improve their ESG activities like the reduction of emissions, which require top dollar.

Strategy to Drive ESG, Not the Other Way Round

Over the past few years, increased stakeholder expectations and a regulatory environment mandating ESG disclosures have seen ESG reporting driving the sustainability strategy at organizations rather than the other way around.

However, in 2022, more companies will be informed and have a better understanding of ESG at all levels. This means sustainability will not just be a risk mitigation strategy, but also a big factor in competitive advantage. As such, it will be strategy driving ESG reporting moving forward.

ESG for Venture Capital as Well

While historically it is mostly large and publicly traded companies that have progressed the ESG agenda, this year provides venture capitalists working with companies at an early stage with a special opportunity to help founders get ESG right from the get-go.

This is because VCs seek to back companies that will have long-term transformational and positive impacts on society, and supporting portfolio companies with appropriate ESG tools and perspectives at the early stage helps them achieve just that.

Focus on the ‘S’ in ESG

Covid-19 has exposed systemic social problems, bring social issues to the forefront of public and corporate discussions.

While 2021 has been mostly about Environmental issues, investment in the post-Covid world of 2022 will focus on social issues such as human rights, diversity and inclusion. By effectively managing social issues, companies can secure access to environmental resources, build human capital to secure a motivated, productive and skilled workforce needed as people return to normal office duty, benefit from a competitive advantage in the market, and strengthen their supply chains.

Are you ready for the year of ESG? Worry not, Intaba Africa is here to help you thrive in ESG compliance and all areas of investor relations as you take your firm to the next level.